Financial Industry Solutions

Project Highlights

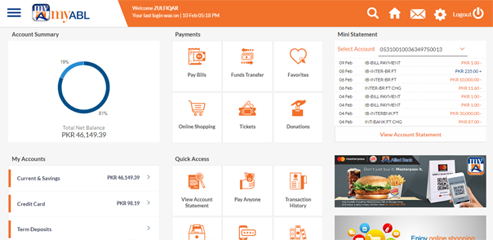

Allied Bank upgrades myABL to latest version of Oracle Banking Digital Experience

MyABL, the Digital Banking Platform offered by ABL, provides customers an omni-channel, feature rich experience. Along with the standard internet banking functions, myABL offers advanced transaction banking coupled with the latest authentication features including Biometrics, PIN/Pattern and Face ID. MyABL is also integrated with fintech solutions for buying online Tickets and support digital payments through QR Codes. As part of the myABL rollout, Techlogix also implemented IBM Enterprise Service Bus as a middleware platform to integrate internal systems including Temenos T24 core banking with myABL.

Askari Bank has signed the complete automation of the Enterprise Risk function with Techlogix using the Oracle Financial Services Applications and Analytics (OFSAA) platform.

As the only Oracle Partner with successful implementations of ERM in commercial banks in Pakistan, Techlogix was the natural choice for Askari Bank. This project involves implementing Asset Liability Management, Liquidity Risk Management and BASEL solution as the first phase. As part of project, we are also implementing Oracle Data Integration Hub to centrally manage the provisioning of data across multiple systems.

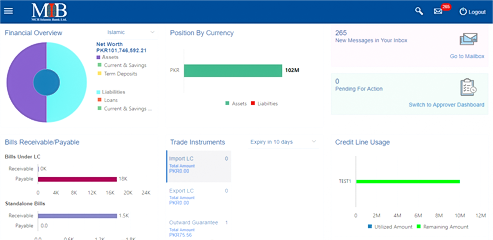

MCB Islamic Bank becomes first bank in Pakistan to offer Corporate Banking with Oracle Digital Banking Experience

MCB Islamic Bank has successfully launched Corporate Internet Banking on the Oracle OBDX platform. As the Implementation Partner, Techlogix configured and customized the Digital Corporate Banking solution for MCB Islamic Bank. Key features specific for Corporate Banking include multi-step workflows for transaction authorization, Trade Finance capabilities as well as an extensive Cash Management feature.

Asset Liability & Liquidity Risk Mgt Implementation underway at ABL

After successful rollout of GL Reconciliation, BASEL and Market Risk solutions at Allied Bank, Techlogix is now implementing Oracle Asset Liability Management & Oracle Liquidity Risk Management solution with them. Techlogix will leverage on ABL Risk data which bank has provisioned already by implementing Risk Modules. Now with lot of automation in data acquisition part, ABL is now looking forward to generating regulatory and ALCO reporting through system.

Customer Wins

Compliance

Flexcube

ERM

Go-Lives

Compliance

Transforming Analytics

Flexcube

ERM

Our Services

Core Banking

We are one of the few Oracle partners globally with a track record of successful implementations of Oracle FLEXCUBE in Conventional, Islamic & Microfinance banks. With more than 100 consultants, our Core Banking team has the size and depth needed to deliver FLEXCUBE projects successfully.

Compliance

Techlogix offers implementation services for Oracle’s Financial Crimes and Compliance Management (FCCM) suite as well Accuity Compliance Link. Techlogix helps customers and key stakeholders get a 360-degree view of financial activities and customer risk and to detect and investigate potential non-compliant behavior.

Digital Transformation

Techlogix provides compete Implementation and development Services to its Customers in rolling out the Oracle Banking Digital Experience (OBDX) Platform. OBDX enables banks to attract, onboard, and service customers with a context-aware solution powered by a robust API framework that integrates with any core banking solution including Oracle FLEXCUBE and Temenos T24.

Risk Management

Techlogix provides a comprehensive suite of services based on Oracle Financial Services Analytical Applications (OFSAA). From Basel Regulatory Capital through Market Risk and Operational Risk to Asset/Liability Management and Liquidity Risk Management, our consultants have helped Banks automate their Risk Management processes.

TMX-DLP Digital Lending

Using our TMX platform, Banks can transition to Digital Lending: from origination to disbursement and collection. TLX Mobility builds cloud-based mobility products to empower employees and customers to execute tasks in the field right at the point-of-work. Using our solutions, Banks and other Financial Institutions can enable digital interactions with customers and reduce operational costs and business process cycle times. We work with Banks to deliver process automation solutions governed by an analytics framework.