MCB Bank is one of the five largest banks in Pakistan with an asset base of almost $10 Billion. With over 1,200 branches, MCB serves more than 5 Million customers.

MCB Bank, one of the largest banks in Pakistan, selected Oracle FLEXCUBE Universal Banking for its International operations across three countries. MCB Bank has been at the forefront of customer excellence and technical innovation and recognized as the Best Domestic Bank in Pakistan by Asiamoney. The Bank wanted a core banking solution that supported a multi-country roll out with support for local banking regulations along with MCB’s core requirements of centralized operations and a full suite of retail and corporate customer products.

A key challenge was in UAE where MCB was establishing a banking presence for the first time. The bank management wanted to make sure that all systems were fully in place to support branch operations from the very first day and this required a complete rollout of FLEXCUBE within four months.

MCB Bank partnered with Techlogix for this fast-track green field implementation. The foremost objective was to configure and implement the solution for the UAE operations with a full set of asset, liability and trade finance products.

The Techlogix team engaged with the Bank team and set out an ambitious plan with project launch in the first week of August 2014. Working closely together, Techlogix and MCB Bank successfully completed the User Acceptance Testing mid-November and handed over the solution to the Business team for Branch Go-Live.

The Challenge

MCB Bank selected Oracle FLEXCUBE for the transformation of their international operations. The objective was to standardize business processes, adopt global best practices wherever applicable and deliver a high quality customer experience. A phased approach was adopted by rolling out FLEXCUBE in UAE, Bahrain and Ireland sequentially.

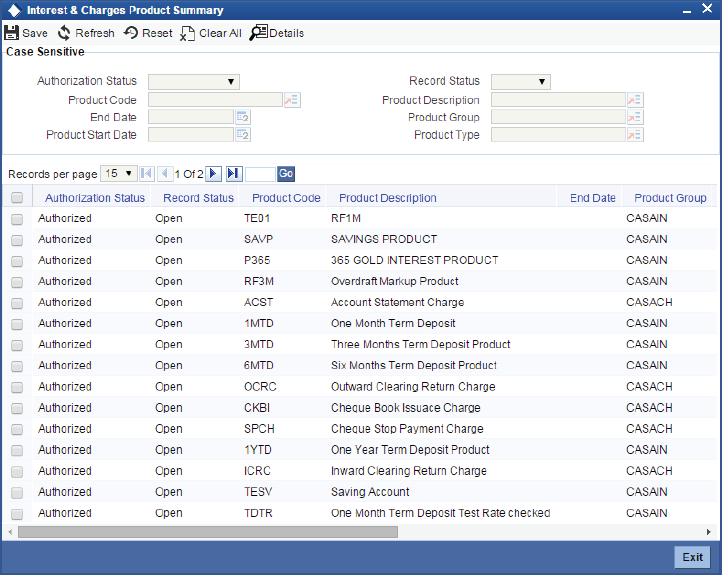

The first rollout in the UAE was especially challenging given the short four month timeframe available for the complete rollout. In addition, in a mature Banking market, MCB wanted to launch with a comprehensive portfolio of products. As a result, the implementation footprint was quite substantial. The Bank selected the following FLEXCUBE modules to be configured initially for its UAE operations:

- Core

- Current Accounts & Savings Accounts (CASA)

- Term Deposits (TD)

- Retail Teller (RT)

- Letters of Credit (LC)

- Bills & Collection (BC)

- Limits & Collateral Module (ELCM)

- Lending/Loans (CL)

- FLEXCUBE XML Interface (for interfacing with external Systems)

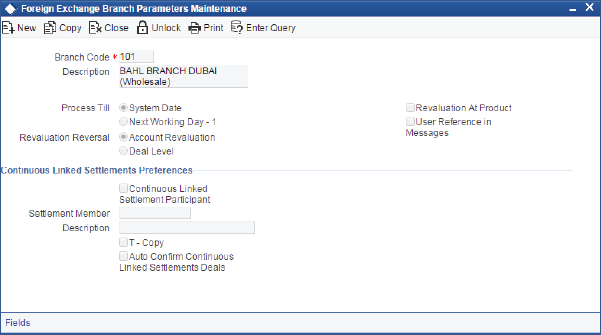

Aside from the baseline financial products selected by MCB, the solution also had to be compliant with the requirements of the Central Bank of UAE. These required support for a set of external interfaces that are mandatory. The required interfaces included:

- ICCS (Clearing)

- DDS (Direct Debit)

- FTS (Fund Transfer/Local Remittances)

- WPS (Wage Payments)

A final challenge was the development of statuary reports within the highly compressed timeframe available.

Solution

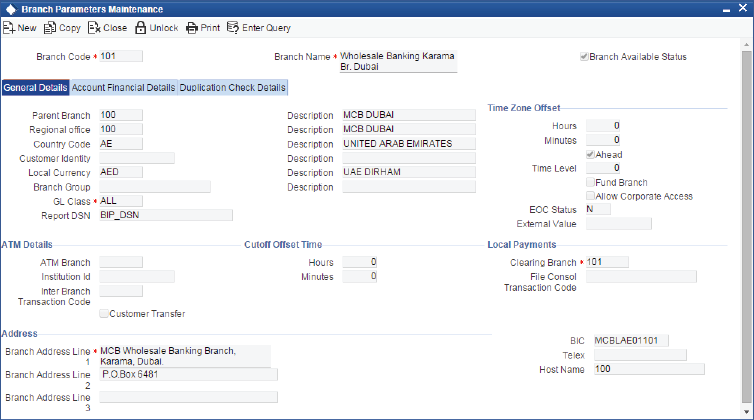

Techlogix deployed a team comprising of seven resources from Techlogix which worked closely with a six member functional and technical team from the Bank. The team completed the following major activities during the project:

- Identification of gaps and formulation of workarounds where possible

- Consolidation of the bank’s General Ledger in accordance with the products being offered in UAE and the central bank’s requirements

- Design and configuration of products

- Customizations of Banker’s checks and Term deposit advices specific to the Bank’s pre-printed stationary

- Design and implementation of interfaces for Clearing, Fund Transfer, wage payments and direct debits

- Training for the Bank’s Core Team and End Users

- Testing Strategies and test cases (aimed at User Acceptance Testing, System Integration Testing, business simulations etc.) based on a library of approximately 5,000 test cases pre-developed by Techlogix

Key Contributions: FLEXCUBE Delivery Innovation

Techlogix delivered the 1,000+ person day project within the contracted timelines and on the agreed upon quality parameters. This implementation was acknowledged as one of the fastest Core Banking implementations in the region with successful completion of all major milestones within time.

The key project delivery innovations which allowed Techlogix to implement FLEXCUBE within this timeframe included:

- Introduction of easy to comprehend, business user oriented product definition sheets for requirements gathering.

- Senior experienced resources with experience in multiple geographies including the Middle East and Pakistan which allowed Techlogix to assist the Bank in mapping its local practices into viable and compliant product offerings in the UAE.

- Prevention of any unnecessary scope creep to avoid loss of focus on the main objectives.

- Helping the Bank’s technical resources on reports development which allowed for the complete report requirements to be addressed.

Benefits to MCB Bank

- Launch with a comprehensive product portfolio which was competitive in the UAE market.

- Online and timely reporting for all levels of management for easy analysis and fast response to market trends and customer needs.

- Optimization of operational expenses for UAE operations by keeping a large portion of the implementation team (both Techlogix and Bank) offsite while relying on Techlogix’s global delivery implementation methodology to achieve the

required timelines. - Automation of the complex clearing and fund transfer processes with Oracle FLEXCUBE.