Our client is amongst the top ten commercial banks in the United States with an asset size of more than 400 Billion US Dollars.

The bank operates more than 3,000 banking offices and more than 5,000 ATMS in 25 states across the US. It provides a comprehensive line of banking, brokerage, insurance, investment, mortgage, trust and payment services products to its customers.

Techlogix worked with our customer to develop a solution that automates incoming, outgoing and trust to trust account transfer transactions for more than 2,000 corporate users. At the core of the solution is IBM Business Process Manager that integrates the Bank’s accounting system and its enterprise wide content management solution.

The customer had a system of record for capturing the actual securities transactions. However the front end business processes of capturing a transaction request, confirming compliance and authorizing the transaction were entirely manual. The primary goal of the solution was to create a standardized and automated business process for managing securities processing for high value customers.

A custom dashboard for SPQR now provides monitoring and control of requests. An extension of the system has also been implemented to automate personal and corporate trust account opening which involves extensive data capture and compliance processing.

A comprehensive reporting system includes reports on Service Level Agreements (SLAs) and transactions and accounts volumes. Regulatory requirements such as Anti Money Laundering (AML) and Office of Foreign Assets Control (OFAC) compliance have been automated to reduce human error.

The Challenge

The Bank’s account opening and transaction handling process for securities involved a large front office staff across various business lines and markets.

The process for opening of a new customer or corporate trust account was tedious and manual. There was no central repository for supporting documents required for compliance and a large number of long paper forms to complete. This resulted in both high processing costs and also significant delays in processing an account opening request.

The process for handling securities transaction requests was also mostly paper and email driven. Reviews of securities processing transactions was done through emails exchanged between front office staff and managers. The securities requests were maintained in multiple Excel spread sheets and an Access database. Non-standard Excel macros were used to extract and format data to post into the SEI Trust 3000 accounting and transaction processing system. Finally closing activities were also manual and paper based.

This manual processing and the lack of uniform enforceable practices on Anti Money Laundering (AML), Risk Calculation and Office of Foreign Asset Control (OFAC) regulations could also result in significant government imposed penalties.

Finally, reporting was cumbersome and manual computation was required for the creation of metrics to measure SLAs and to generate cost basis reports. This resulted in a lack of insight into the operations of the business unit.

Solution Implemented: SPQR

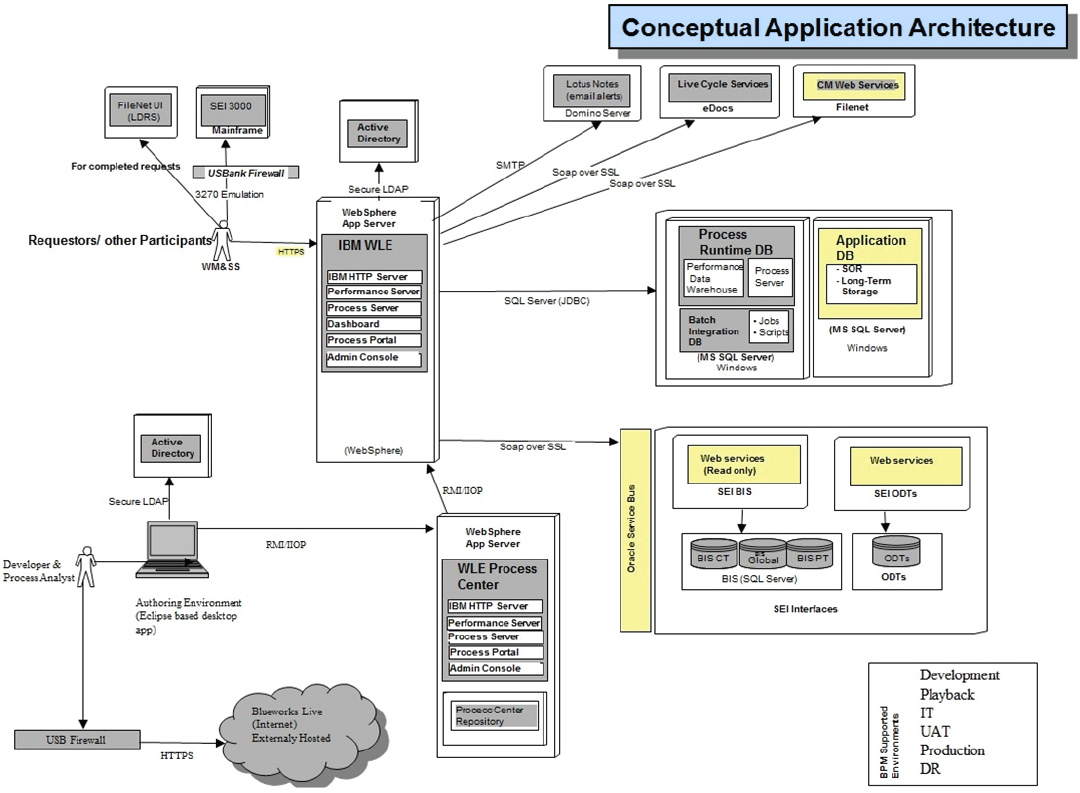

The solution is to automate personal and corporate trust account opening and securities processing processes using IBM Business Process Manager and integrating it to backend systems.

The key features of the solution include:

- Integration with the SEI Trust 3000 transaction processing system for automatic processing of securities transactions.

- Integration with the Bank’s document management system for storage and retrieval of relevant documents.

- New System of record creation for all securities processing requests.

- Custom dashboard for monitoring any request status and securities processing.

- Reports for SLAs, MPR and Cost Basis processing.

- Audit information on securities processing from request creation to completion.

- Automatic assignment of tasks to back office staff.

- Modern web enabled user interface to replace green screens processing for front and back office staff.

- Automatic notifications to appropriate users for important scenarios.

- Automatic assignment of tasks to back office staff for review of information, AML processing, risk calculation and OFAC processing.

- Automatic notifications to appropriate users for important scenarios.

- Better compliance with Federal and State regulations on AML, OFAC, PEP, and KYC.

Benefits

The key benefits of system include:

- Process monitoring and control.

- Application modernization.

- Reduction in manual processing time.

- Integration and automation with the backend transaction processing system and document management repository.

- System of records for requests for reporting and analysis for other enterprise functions.

- Improved SLA conformance.

- Automated account creation process significantly reduces the overall processing time.

- State of the art reporting and control dashboard.

- Periodic and on-demand reporting.

System Architecture