Bank AL-Habib is a commercial Bank with operations across Pakistan and assets of over US$ 5 Billion. In operation since 1992, the Bank has more than 700 branches.

Bank AL Habib (BAHL) operates throughout Pakistan with a network of 500+ branches and over $6 Billion in Assets. It also has overseas operations in Hong Kong, Seychelles and Malaysia. The Bank wanted to implement a comprehensive risk management solution to address local regulatory guidelines in each of its four jurisdictions.

The Bank acquired Oracle Enterprise Risk Management and engaged Consulting and Implementation Services from Techlogix. The Project covered two phases: The first phase targeted implementation of the Basel III requirements and the deployment of modules for managing Market Risk and Operational Risk. In the second phase, the Bank is implementing Asset and Liability Management and Liquidity Risk Management.

Basel Capital Adequacy: Standardized Approach

Financial institutions can accelerate their Basel Capital Adequacy compliance initiatives with the Oracle Financial Services Regulatory Capital solution.

BAHL’s requirement for Capital Adequacy calculation were quite extensive and challenging given the number of jurisdictions and the fact that the Bank has both Conventional and Islamic banking operations. The following is a list of the major requirements of BAHL:

- State Bank of Pakistan Jurisdiction – Basel Capital Calculation:

- BAHL – Basel III (Stand-alone and Consolidated)

- BAHL – Basel III (Stand-alone and Consolidated) for Islamic Banking Operations

- AL-Habib Capital Market Basel III (Stand-alone)

- Seychelles Jurisdiction – Basel I Capital Calculation.

- Malaysia & Hong Kong Jurisdictions – Basel Capital Calculation: Basel III (Stand-alone).

Furthermore, the Bank asked the following approaches/requirements to be implemented:

- Implement the Oracle Reconciliation Framework to help the Bank reconcile its figures from operating systems (Core Banking, Treasury, Cards etc.) with the Bank’s General Ledger.

- Credit Risk Mitigation with Simple and Comprehensive approaches.

- OEM and CEM approaches for off-balance sheet market related instruments.

- Maturity and Duration approaches for Market Risk general charge calculations.

- Configuration of look through approach for investments in mutual funds.

- Separate runs for AFS portfolio by considering it a part of trading book.

- Configuration of rules for determination of reciprocal cross holdings.

- Configuration of State Bank of Pakistan’s mandatory stress testing scenario for Credit and Market Risk.

- Capital adequacy reports for Basel I and III for each Jurisdiction.

Challenge

Implementation of Basel Regulatory Capital is always a challenge, both from business and technical standpoint. Some of the key challenges faces in the implementation are highlighted below:

- For BAHL, multiple approaches, multiple jurisdictions and multiple runs complicated the data requirements considerably.

- Basel III rules are vast in number and each jurisdiction has used its discretion to evolve its regulatory guidelines. Multi-jurisdiction implementation therefore requires very deep understanding of the regulations.

- Since the Oracle solution has pre-built rules based on BIS regulations, a careful analysis is required to cater for the differences in rules across jurisdictions.

- The reporting requirements for Basel III are extensive with a large variety of required disclosures. Identifying these elements, finding out the appropriate data and data sources requires a lot of involvement with different stake holders.

Key Benefits

- Provides credit, market and operational risk measurement in accordance with Basel III guidelines and fully customized to the local regulatory requirements.

- Basic, standard and advanced internal calculation options are pre-built and delivered in an advanced data warehouse-based framework for consistency,

accuracy and extensibility.

Operational Risk Management

Techlogix was also tasked with implementing Oracle Financial Services Analytical Applications (OFSAA) Operational Risk at BAHL. The solution will help the Bank in driving meaningful analysis of operational risks, achieving efficiency in operations and bringing accuracy in regulatory reporting.

BAHL Operational Risk Management is responsible for identifying, measuring, reporting and monitoring operational risks for the entire group at a branch and department level.

Prior to this, BAHL had an internally developed solution that mostly catered to Loss Data Management. The rest of the framework was manual in nature with no concept of risk repositories, automated linkages between different functions and follow up procedures for notification and tracking.

Techlogix designed a solution based on the functionalities offered by OFS Operational Risk Management solution and mapped Banks requirements to the solution. The framework offers an integrated method of linking all the Risks, Controls, Incident Management, KIs, Issues & Actions, Compliance, Insurance, Scenarios and Audit Assessment.

Challenges

- BAHL had a mature Operational Risk Loss Data capturing framework. Replacing an existing solution was a difficult task from a change management perspective.

- Techlogix wrote scripts for the automated upload of various configuration related activities such as populating the processes, risk libraries, control libraries, KI libraries etc.

Key Benefits

BAHL has obtained the following benefits from the implementation of the solution:

- Work with an enterprise-wide view of all operational risk data to ensure a single, consistent view.

- Eliminate redundant efforts and inconsistent results through a common, pre-built operational risk application.

- Identify measure and mitigate all types of operational risks across the entire business.

- Confirm that the enterprise is optimally insured and identify cost saving opportunities through over-insured risks.

- Establish and maintain controls to keep operational risk levels aligned with financial risk appetite.

- Work on regular assessments of both risks and controls.

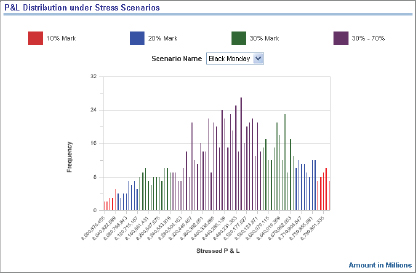

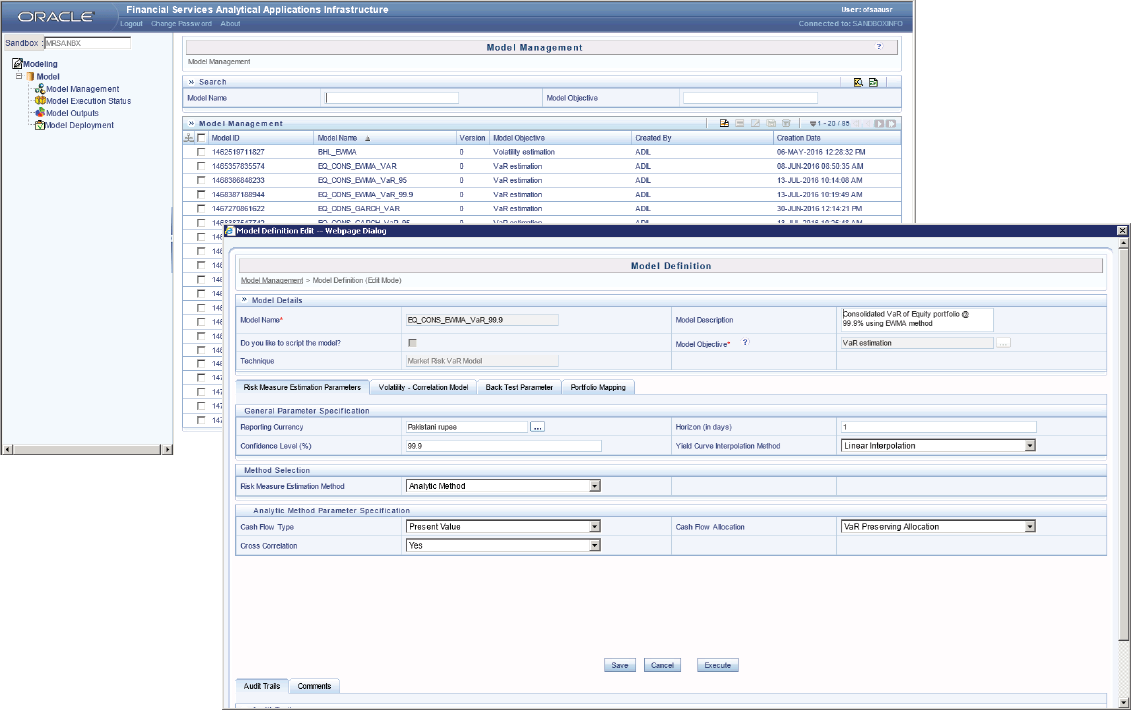

Market Risk Management

Oracle Financial Services Market Risk Management Solution enables Banks to quantify and manage risk arising due to movement of risk factors such as interest rates, equity prices and exchanges. The application supports volatility estimation of these risk factors using EWMA and GARCH methods. The application facilitates risk managers with critical risk measures such as VaR, CVaR, Component VaR, Marginal VaR, and Incremental VaR. It also provides simple and Kupiec Back-testing approaches to gauge the accuracy of VaR predicted by VaR Model.

Key Benefits

After Implementation of Market Risk, BAHL is capable of performing the following tasks on a daily basis:

- Estimation of volatility measure such as variance – covariance, volatility, mean etc. for all risk factors relevant to bank by using EWMA and GARCH methods by taking into account correlation for all risk factors.

- Calculation of VaR measure such as portfolio VaR, Component VaR, Conditional VaR, undiversified VaR on configured portfolio using Historical Simulation, Analytical and Monte Carlo simulation over 1-day horizon on 95% and 99% confidence level.

- Cash-flow generation for instrument level and risk factor asset-asset class-maturity level.

- Net present Value calculation for OTC instruments.

- Profit or Loss of the portfolio against the portfolio value as on the current day for all portfolios.