Techlogix has worked closely with Al Fardan Exchange over

a number of years and delivered a number of projects for us. The Integration Backbone was a key enhancement in our systems infrastructure and has allowed us to provide an entirely different level of customer service. This is reflected in an increase in our business volumes. Techlogix was a crucial part of envisioning and delivering this solution and we continue to use their Application Management services to support and enhance this for us. We look forward to an ongoing partnership with Techlogix.

Syed Irfan Ahmed

Assistant Vice President

Al Fardan Exchange is one of the largest currency exchange based out of Qatar. Aside from changing currency notes, funds transfer and remittance is a key business segment for Al Fardan. Qatar hosts a non-resident population of more than 1.5 million workers drawn from across the world but with significant concentrations from South Asia, Philippines, Indonesia and Egypt. A large majority of this work force remits money to their home countries on a monthly basis. However, commercial banks in Qatar typically are not very interested in this business as it distracts their branch staff from serving their top end clientele.

Al Fardan Exchange saw an opportunity to provide high quality service to this customer base and establish a brand as the leader in this space. Given the essentially simple nature of the transaction, a key differentiator for Al Fardan was to provide support service and establish a large correspondent banking network to allow its customers the convenience of funds remittance to their home banking institution of choice.

This rapid multiplication of third party relationships led to a situation where the manual connectivity between Al Fardan and its correspondent banks could no longer be sustained and posed a significant business challenge. Hence, Al Fardan asked Techlogix to establish an integration backbone which would be used as a standard platform for connecting its internal systems with correspondent banks across the world.

Al Fardan Exchange is one of the largest money exchange and funds remittance companies in Qatar and UAE with correspondent relationships with more than 120 banks worldwide. It is part of the Al Fardan Group, Qatar with major interests in Real Estate, Financial Services and Trading.

The Challenge

Al Fardan Exchange was facing several issues with their remittance transactions:

- The absence of real-time system integration meant that agents at correspondent banks had to manually download their respective remittance transactions and import it into their system one or more times in day.

- This reliance on manual data entry resulted in delays in the remittance being credited to the beneficiary.

- Work through constraints like data unavailability and generate data for quality testing of reports.

- Maintaining separate accounts for representative of each correspondent bank around the world to login to the Al Fardan Exchange Online Remittance system and download their remittance transactions. Since this access was granted to a third party employee, Al Fardan felt this was also a potential security risk.

- Confirmation of transaction completion within the correspondent bank was not available. Thus, Al Fardan could not accurately report the status of the remittance to its customers.

Solution Requirements

Al Fardan Exchange asked Techlogix to develop a messaging layer to communicate with the correspondent banks in different countries to send remittance instructions and confirmations in real-time. The major solution requirements were:

- Flexibility: Given the 100+ banking relationships maintained by Al Fardan, the key requirement was to design a system flexible enough that any new correspondent bank could be easily integrated without any changes on the bank side.

- Security: Since financial transactions are involved it was very important to ensure the end-ti-end security of such transactions and design the system to facilitate security requirements of each correspondent bank.

- New Capabilities: Al Fardan also wanted to act as an aggregator of remittance services. Thus the system also needed to integrate with other third party exchanges which wanted to use Al Fardan correspondent banking network to remit funds.

Solution Strategy

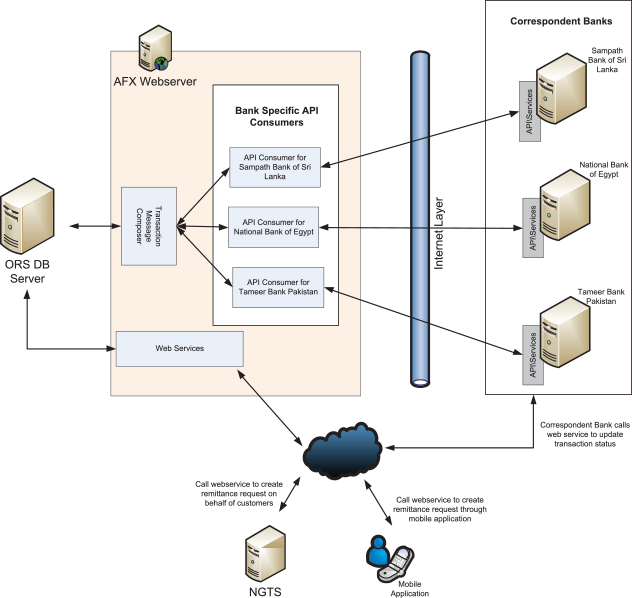

The major challenge in this project was that the integration backbone had to communicate with both the Al Fardan system and various Bank APIs without mandating any changes in these systems. Each bank had its own messaging format and API specifications and these had to be catered for in the new integration backbone.

The middleware component was implemented in Java and communication layer was built using Apache Message Queue server. All data communication between different components was done on message queues to ensure robust and fast communication. Keeping in view that any bank can change the definition of their remittance APIs, the middleware component was designed to be flexible enough that any such change could be managed through configuration changes. Thus all message and API definitions are obtained by the integration backbone dynamically through XML files.

Besides just pushing remittance instructions from existing Al Fardan’s system to relevant correspondent banks; the middleware component is also designed to facilitate obtaining status of transactions from respective correspondent bank and update this status in Al Fardan’s own system in real-time. This allows Al Fardan personnel to monitor the status in their system and then take appropriate actions in case the transaction encounters a problem or fails for any reason. Failed transactions are now corrected in the Al Fardan system (for example by correcting an error in the Account Number) and then automatically picked up by the Integration Backbone for reposting.

The integration backbone provides a number of connectivity options including:

- SOAP Services

- XML over HTTP services

- FTP based processing

Solution Architecture

The Techlogix team designed and deployed the solution on a network of clustered Solaris servers. The diagram below shows the high level architecture of the solution.

Benefits

This integration with correspondent banks provided Al Fardan Exchange the following critical benefits:

- Zero manual work required in sending remittance to the correspondent banks and getting real-time updates of the transaction status in existing web-base

remittance system. - Immediate transfer of remittance to the Beneficiaries’ account in any other country.

- Immediate update of transaction status in Al Fardan Exchange’s existing remittance system.

- Significant increase in business volumes due to enhanced customer service.

- Flexibility in design to integrate other corresponding banks quickly and efficiently.

- Enabled Al Fardan Exchange’s system to receive remittance instructions through any of the thirdparty companies or banks in Qatar that allow their customers to send remittance to any country around the world through Al Fardan Exchange.