The client is a universal bank providing diverse financial products, services, and bespoke banking solutions to a wide client base in the GCC, Europe, and North America. The bank employs over 1,000 professionals around the globe, and provides corporate and investment banking, asset management, and Shariah-compliant banking services.

As a leading bank in the Gulf region, our client has built a reputation for delivering innovative wholesale banking, treasury, investment, and asset management solutions to private corporations and government entities. Headquartered in Saudi Arabia, the bank has built a long-standing presence across local and international financial hubs.

The client needed to modernize its data landscape and architecture to address key challenges such as building a scalable banking data model, legacy integration, and adoption of best practices in data governance across its corporate culture. Further, the National Data Management Office—NDMO under the Saudi Central Bank, SAMA, enforces strict governance policies pertaining to data management, protection, and sharing. The initiative needed to align with NDMO regulatory requirements.

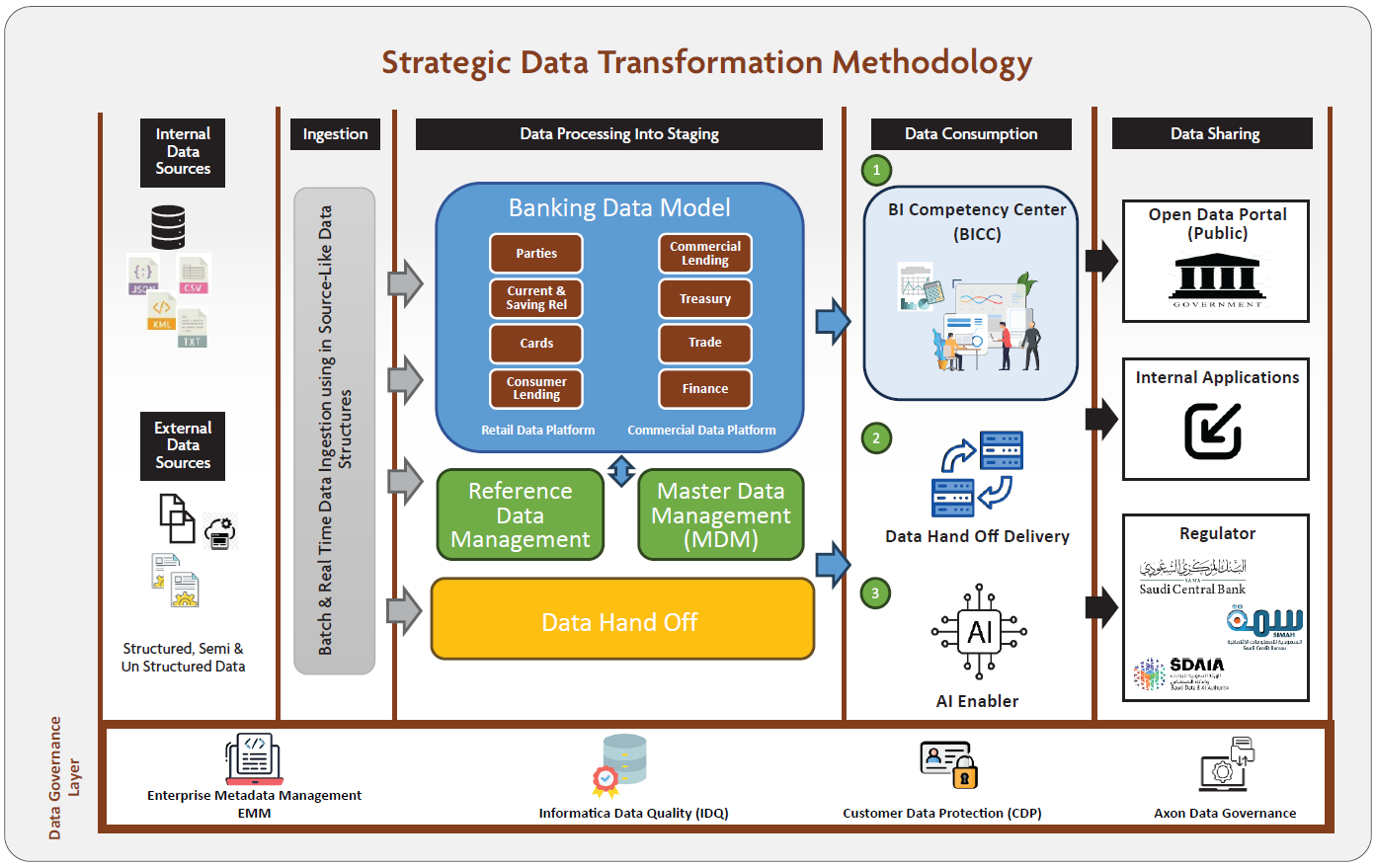

The bank engaged Techlogix to modernize its enterprise data architecture, platform and methodology. The initiative introduced a scalable banking data model, modern integration platform, and a robust governance framework. This enabled self-service business intelligence for the bank’s business teams, advanced analytics, and readiness for machine learning and generative AI use cases.

The Challenge: Obsolete Data Architecture and Governance Framework

Outdated Data Architecture & Technology: Transitioning from legacy reporting systems toward a modern data architecture posed issues in redesigning ingestion, staging, warehousing, and semantic layers. This shift needed to support both current and advanced technical demands, while incurring minimal disruption to ongoing business operations.

Lack of a Scalable Data Model: Developing a model that could serve both operational and enterprise reporting and analytics was a significant challenge. The model had to balance efficiency, scalability, and adaptability for evolving business and regulatory requirements.

National Data Compliance Gaps: The bank was required to comply with SAMA’s NDMO mandate constituting 11 key pillars focusing on efficient and secure data management in compliance with national policies. It also needed to adhere to diverse regulatory requirements across all regions of operation.

Deficient Data Governance Practices: Beyond technology, the client needed to embed a data governance mindset across the organization. The challenge was to build a culture where business and IT teams collaborate effectively, balancing innovation with compliance requirements.

The Solution: A Modern Data Ecosystem

Techlogix led a data transformation program to enhance the client’s legacy data landscape. The program engaged a wide spectrum of specialized resources including data architects, data analysts and modelers, data engineers, and quality and data governance associates. A phased approach paved the way for success starting with data governance foundations followed by platform modernization, and finally advanced analytics/AI adoption.

Data Architecture: Techlogix designed and built the following:

- Robust data ingestion pipelines

- A secure staging layer

- A centralized data warehouse

- Well-defined semantic layers to support advanced analytics and reporting

Banking Data Model: The team designed and implemented data models tailored for reporting and analytics structured at both denormalized and Star Schema levels. This dual-layer approach optimized query performance, standardized data access, and ultimately enabled faster and more seamless delivery of business insights.

Data Compliance Supervision: Following the guidelines of SAMA, Techlogix consultants supervised the implementation of the NDMO standard. This was accomplished over a 3-year enterprise-wide transformation structured around people, processes, and technology.

Data Governance and Quality: Data governance, Master Data Management, and quality frameworks were introduced, supported by enabling technologies.

Data Integration Platform: An integration platform was implemented to operationalize the model, providing scalable integration and efficient data movement across the banking ecosystem.

The Technology

Data Staging Environment: The client’s data journey began with a staging setup built via:

- A multi-instance core banking system data aggregation

- An integration platform built on SQL Server Integration Services (SSIS)

Retail Data Platform: Aiming to make reporting faster and easier, the platform encompassed:

- A retail data mart built on a Star Schema

- Self-service BI capability through a BI Competency Center using SSAS & Power BI

NDMO-Compliant Enterprise Data Platform: The focus then shifted towards establishing a fully NDMO-compliant data management platform. The Informatica data governance suite was leveraged to ensure robust governance, data integrity, and regulatory alignment, using below tools:

- Master Data Management and Enterprise Metadata Management

- Axon Data Governance

- Informatica Data Quality

- Customer Data Protection

NDMO-Compliant EDP+:

- This extension made the platform real-time, AI-ready, and business-friendly with Lakehouse storage, semantic data layers, and strong self-service analytics.

- The modern integration system leveraged Informatica PowerCenter for real-time ingestion and handling unstructured data, allowing the bank to support advanced use cases.

- Analytics were further improved through a semantic layer and exposed data marts, while the BI Competency Center continued enabling business teams to create their own reports and proofs of concept for analytics.

Key Benefits

Over an ongoing engagement of more than 12+ years, Techlogix has realized the following benefits for the client:

- Data Architecture & Model: The enterprise data landscape was transformed with an upgraded design and specialized technology stack sustained by a structured governance framework.

- Business Insights: The bank was enabled with a self-service business intelligence framework, empowering users to create their own reports and dashboards. It set the foundation towards the vision of advanced analytics through machine learning and generative AI.

- Time Savings: Overall analytics delivery cycle was reduced by 65%, decreasing reliance on IT.

- Process Compliance Goals: Improvements were observed in 23 NDMO data specifications, 5 key data processes, and the data sharing process.