GIB is a leading bank in the Middle East with its principal activities based in Bahrain and Kingdom of Saudi Arabia.

Gulf International Bank (GIB) is a leading bank in the Middle East with its principal activities based in the Gulf Cooperation Council (GCC) states. In 2014, as a major strategic initiative, the Bank launched Retail Banking in the Kingdom of Saudi Arabia. At the same time, GIB upgraded its core banking solution to Oracle FLEXCUBE and selected Oracle Business Intelligence as its enterprise analytics platform.

To transform its existing statutory and operational reporting to Oracle Business Intelligence, GIB selected Techlogix to setup an enterprise wide analytics capability. Additionally, the Bank tasked Techlogix with migrating 150+ reports from the legacy environment to the new Oracle based solution. This also required integration of data from a variety of external systems which managed operations for functions such as Treasury, Trade Finance etc.

The Challenge

GIB had multiple systems and technology platforms to meet its growing customer base and diverse banking operations in multiple regions around the world. A major challenge was to develop 150+ financially accurate reports compliant with the requirements of the internal regulatory compliance unit of the bank and those of SAMA (Saudi Arabian Monetary Agency).

Added to this technical challenge was a requirement to complete the project in sixteen weeks to coincide with the Bank’s scheduled User Acceptance Testing date for FLEXCUBE. This was further complicated by the fact that certain business requirements were still evolving in parallel.

The Solution

To deliver the data mart and the associated 150+ reports, Techlogix structured a team led by a Data Architect along with 15+ professional developers and consultants to complete the entire project in a 16 week period. As the Bank was implementing Oracle FLEXCUBE Universal Banking, Techlogix brought on board its certified FLEXCUBE consultants to work through the project life cycle and help produce key deliverables.

Working in an onshore-offshore model the following project practices ensured success:

- Analysis of existing reports to understand the business requirements and the business logic.

- Based on business requirements the Techlogix team had to reverse engineer the data requirements from FLEXCUBE i.e. the ultimate reporting goals drove the effort as opposed to the historic usage of data from various systems.

- Work through constraints like data unavailability and generate data for quality testing of reports.

- Conduct workshops to demonstrate prototypes for Day Zero reports to stake holders and mature the report requirements based on user feedback.

- Consolidate similar reporting requirements into single selectable reports which provided easier and lower cost maintainability while preserving data security.

- Impart training to bank IT users on Oracle Business Intelligence to support future amendments and new reporting requests.

Key Contributions

Common Staging Area for Reporting

The Bank did not have a common staging area for holding enterprise level data for bank wide reporting. Multiple legacy reporting applications were exchanging data across different systems in an inconsistent and non-scalable manner.

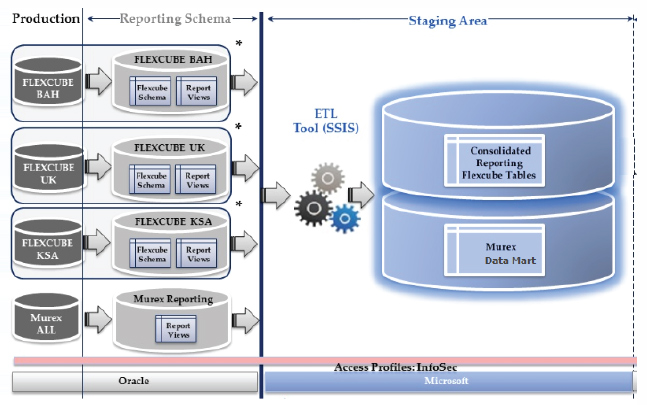

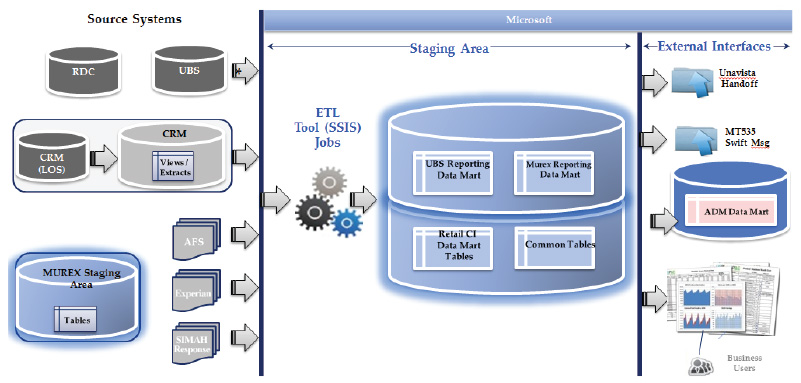

Techlogix designed the required staging area for the bank, where data was collated from multiple FLEXCUBE instances for Bahrain, KSA and UK. In addition to core banking data, this staging area had a number of data marts for CRM, Retail Loan Handoff, SWIFT messages and SIMAH handoff for the external regulator.

At day end, approximately 20 ETL jobs were executed to pull data from these sources in multiple endpoints including Oracle, SQL Server, flat files, XML files and Web services. Some of the ETL applications generated hand-offs for other financial systems to consume. Techlogix designed a robust ETL architecture with built in error reporting and rollback functionalities. This automated the process of provisioning of data and collating it in a well-structured data model to enable the bank to fully meet all its reporting and analytical requirements from single source.

Central Reporting Gateway with Segregated Accessibility

Previously three separate reporting tools were developed in-house which generated the scheduled reports required by the bank. Techlogix consolidated these cross platform reports to OBIEE, positioning it as the single source for enterprise reporting. A two level security model was also defined allowing each individual business unit to access and control the relevant reports.

Regulatory Reporting for Saudi Arabia Monetary Authority

- Regulatory Reporting for Saudi Arabia Monetary Authority was given special emphasis in terms of all applicable rules and data requirements.

- A specific data mart was designed within the data repository for regulatory reports.

Configurable Parameters for Optimal Usability

- The Reporting architecture was designed to make them configurable and scalable with minimal effort to maintain them as the reporting portfolio inevitably expanded over time.

- Parameters like products, calculation criteria, data brackets etc. were maintained as variables outside of the reports, allowing easy to change access and scalability of the reports as the bank introduces new products in its consumer and corporate portfolios.

- Since the Bank operated in multiple geographies with reporting in regional currencies, all reports were parameterized to extract and display data in any currency as configured i.e. SAR, USD, BHD etc.

Project Governance

The following measures were adopted for timed and successful project delivery:

- Close tracking of the project progress throughout all the phases for immediate remedy of ineluctable delays included focused approach on minor tasks.

- Provide visibility of the project status to stakeholders throughout the life cycle for timely decision making.

- Hand holding of business users prior to users acceptance phase.

- Business reporting training to bank technical team and business users for effective use of reports and smooth acceptance cycle.

Our Financial Services

Techlogix implements a full range of solutions for the Financial Services industry focusing on Commercial, Islamic and Microfinance Banks. Our implementation portfolio includes FLEXCUBE Core Banking, Risk Management solutions, Compliance and Anti-Money Laundering and Reporting and Data Warehousing. We also provide Application Management Services for these solutions with both onsite and offsite models. We also implement BPM and workflow solutions which automate and improve operational processes within Banks.