Our client is amongst the top ten commercial banks in the United States with assets of more than $300 Billion.

Operating in 20 states, the bank provides retail and business banking, residential mortgage banking, specialized services for corporations and government entities, including corporate banking, real estate finance and asset-based lending.

Our customer has replaced their manual paper based loan origination system with an IBM Business Process Manager based solution. The previous process for loan origination was manual and paper-based which limited the Bank’s ability to quickly respond to loan requests, created privacy and document security concerns, incurred additional physical storage costs, and limited the flexibility of loan processing staff.

The new solution automates loan processing from origination to closing. Each work step is visible within the process and alerts are issued if any bottleneck is identified. Aging reports are readily available. These are used to prioritize and reschedule resources to optimize process flow resulting in a faster end to end process. The system is fully integrated with the front desk, branch offices and the loan underwriting staff. A comprehensive document management and data extraction system allows rule based automatic routing of applications. This has improved compliance and led to a reduction in errors. Collateral documents are scanned for long term retention and are easily accessible throughout the lifecycle of loan approval and servicing processes.

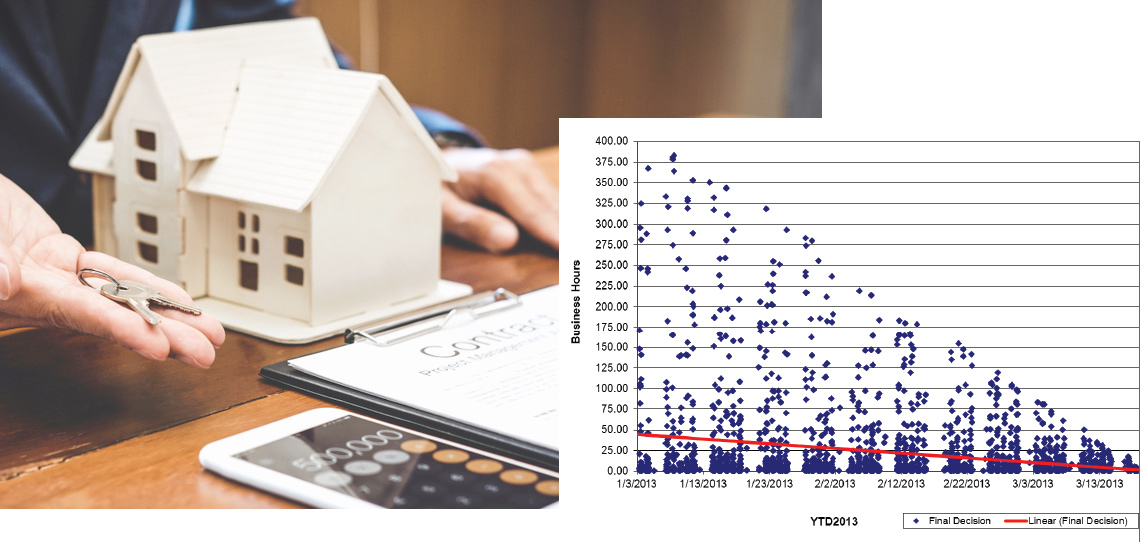

The key benefit of the new automatic system is significantly faster turnaround time for loan decisions. First Decision time on loan application was reduced by 43% and the Final Decision time by 77%.

Exceptionally long final decision time has been reduced to almost 0 since project implementation.

The Challenge

The previous manual paper-based system could not provide visibility into the loan application workflow. Bank management was not able to extract critical information about loan applications such as the number of deals and their aging from within the system. There were multiple work queues resulting in process delays and long cycle times. Process aging information was not reliable and cases could not be prioritized resulting in frustrated customers and loan officers as well as resulting loss of business for the bank. Loan approval and sub-process time could not be measured or predicted with any accuracy. Therefore, a baseline time could not be established for any process. Hence, no Service Level Agreements (SLAs) could be applied, measured or enforced. The Bank recognized this as the classic symptoms of an unmanaged and unregulated process and decided to transform and digitize loan origination as a matter of high priority.

Other challenges faced by our customer included:

- A large front and back office user base that relied on manual application processing. Each location was using their own individual and distinct sub-processes to handle similar cases. This lack of uniformity resulted in both high training costs as well a large variation in end results. The new system needed to develop an optimized and uniform process flow to be adapted by all users.

- There were various heterogeneous systems for loan processing from origination to closing.

- Manual hand offs between various teams from one phase of loan processing to the next resulting in process errors and anomalies when individuals went on leaves or were temporarily reassigned.

- It was difficult to get all the information related to an individual loan application. At any given time during the origination process, current information could reside in various systems, emails, spreadsheets etc.

- A Content Management System was needed to store associated collateral documents.

- Payments, taxes, fees and insurance processing activities were performed by various groups that lacked coordination and information sharing.

Reduced time to business applications (business hours)

- First Decision (hrs): 7 to 4 (43% reduction)

- Final Decision (hrs): 30 to 7 (77% reduction)

Solution

An IBM Business Process Manager based solution was implemented to process loan applications. Additionally, an imaging system was implemented to scan all supporting documents. The images can be scanned either at a branch or sent to Central Operations to be scanned and saved in the ECM system.

The Loan Origination line management team uses the work queues within IBM Business Process Manager to prioritize which applications to review instead of manually sorting through applications to send to loan officers and underwriters for approvals. The solution also eliminates manual viewing and filing of the supporting collateral documents. Documents are validated on screen and exceptions are recorded in the system. Exception reporting identifies which defects are occurring most frequently and where the defects are occurring (at the branch level) so that root causes can be eliminated from the process.

The overarching BPM process tracks loan origination and provides a single place to access associated information. Baseline times have been established for all sub-processes and SLAs are monitored regularly for each process step.

A custom dashboard provides a single view of information in real time for various teams involved in loan processing. Visibility to deals and their respective age allows for effective prioritization and distribution of work. The ability to see process data reveals delays and bottlenecks. This allows continuous improvement in process flow to improve Cycle Times and SLA Performance.

Benefits

The key benefits of system include:

- Single integrated process and data capture.

- Increased process visibility.

- Process SLA reporting and management.

- Operator Productivity Reporting.

- Document Error Analysis Reporting.

- Electronic capture, storage, and retrieval of supporting documents..

- Reduced loan approvals time.

- Reduced numbers and frequency of exceptions in loan processing time.